Financial planning is the method involved with investigating what is happening and building a particular monetary arrangement to reach your goals. As a result, financial planning often delves into multiple areas of finance, including investing, taxes, savings, retirement, your estate, insurance, and more.

As you would expect, a money-related coordinator routinely offers monetary arranging administrations, but financial direction regularly twofold as coordinators themselves. To find an advisor who can help you build a financial plan, try Smart Asset’s free financial advisor matching tool.

What Is Financial Planning?

Financial planning is the act of assembling an arrangement for your future, explicitly around how you will deal with your funds and get ready for all total of the probable costs and issues that might emerge. The interaction includes assessing what is happening, recognizing your objectives, and afterward creating and carrying out pertinent suggestions.

Financial planning is holistic and broad, and it can encompass a variety of services, which we detail below. As opposed to zeroing in on a solitary part of your funds, it sees clients as genuine individuals with various objectives and obligations. It then tends to various monetary real factors to sort out some way to best empower individuals to capitalize on their lives.

Financial planning is not the same as asset management. Asset management generally refers to managing investments for a client. This includes choosing the stocks, bonds, mutual funds, and other investments in which a client should invest their money.

However, the same professionals who offer asset management services can also offer financial planning. A financial planner is effectively one type of financial advisor. Advisors can earn certifications focused on financial planning, the most notable of which is certified financial planner.

Understanding the Different Types of Financial Planning

Here are eight common services that are generally offered as part of financial planning:

- Tax planning: Financial planners often help clients address certain tax issues. They can likewise sort out some way to boost your duty discounts and limit your assessment risk. Some advisors can assist with tax preparation and annual filing.

- Estate planning: Estate planning seeks to make things a bit easier for your loved ones after you die. Setting up a will might be important for a monetary organizer’s administration. Estate planning also helps prepare for any estate tax you may be subject to.

- Retirement planning: You presumably want to stop working someday. Retirement planning services help you prepare for that day. They ensure that you’ve saved enough money to carry on with the way of life you need in retirement.

- Philanthropic planning: It’s always nice to give something to people who need it or assist a reason with shutting to your heart. Monetary arranging can assist you with ensuring you’re doing it beneficially and getting all the tax reductions you’re equipped for.

- Education funding planning: If you have children or other dependents who wish to seek a professional education, you might need to assist them with paying for it. Monetary arranging can assist with ensuring you can do as such.

- Insurance planning: A financial planner can help you evaluate your insurance needs. A couple of financial coordinators are in like manner approved security subject matter experts and can sell you security themselves. Notwithstanding, they’ll probably procure a commission, which would make an irreconcilable situation.

- Budgeting: This is perhaps the cornerstone of financial planning. An organizer can ensure you are spending the perfect sum given your pay and can likewise ensure that you’re not venturing into the red.

The exact services offered by a financial planner will vary based on the individual. Ensure the monetary organizer you pick offers the administrations you want.

What’s Part of a Comprehensive Financial Plan?

The most important thing your financial planner will do for you is not too far off in their name: set up a money-related game plan for yourself as well as your friends and family.

A financial plan is a complete overview of the means you’ll need to take to accomplish the objectives you spread out for yourself. These targets could coordinate paying for your youngsters to go to class, paying for a pleasant retirement, or supporting how much money you pass down to your children.

Your financial coordinator will help you with making a money-related game plan directly following talking with you about your goals and necessities. Then they’ll participate in different administrations, depicted in the segment above, to help you achieve your goals.

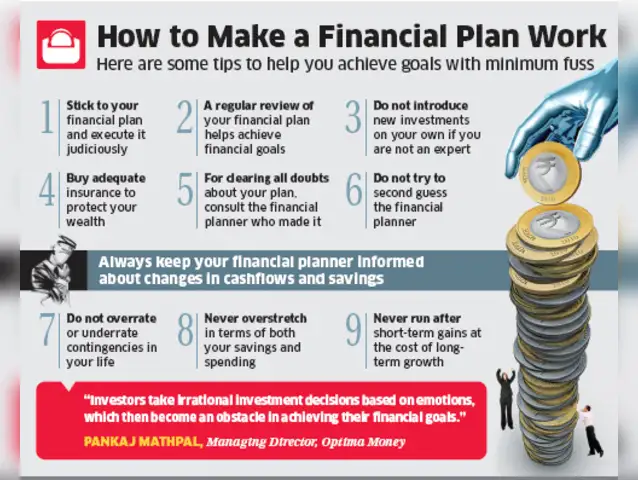

How to Make a Financial Plan

Here are four key facets of a sound financial plan.

Gauge your net worth: Add everything you own and tally up everything you owe. This integrates genuine assets like vehicles and homes, and financial assets like stocks, protection, IRAs, and 401(k)s. The result is your total assets. When you know what you have, you’ll be in a situation to make an arrangement.

Establish financial goals: Step One in the process is making specific goals. This should be inclusive, encompassing funding education, meeting healthcare expenses, creating an emergency fund, planning for retirement, and creating an estate plan.

Monitor cash flow: This is often the most challenging part of making a financial plan, incompletely because a large number of us don’t give especially close consideration to each dollar and dime we spend and halfway because it may not be enjoyable to get very close with your optional spending.

Create pathways to each of your financial goals: In some cases that will mean moving money into high-yield savings accounts, which as of June 2023 were presenting to 4.85% APY. In different cases it will mean squaring away obligations, beginning with the greatest expense obligation, for example, Mastercard obligation. It might likewise mean changing your spending.

How Much Money Do You Need for Financial Planning?

The cost of financial planning depends largely on the advisor you work with and their fee schedule. Advisors often bundle investment advice and financial planning services together, and charge a single fee that’s based on the amount of money you have invested with them – your assets under management (AUM).

A Kitces survey of more than 750 financial advisors in 2022 found that 62% included the cost of financial planning in their AUM fee. Meanwhile, only 22% of advisors offer financial planning services separately via a single, flat fee. This charge may depend on the complexity of the services you require, but the median cost of a standalone financial plan in 2022 was $3,000, according to the same Kitces study.

Other advisors who offer financial planning may do so on either an hourly basis or as part of the retainer they charge. Rates for hourly financial planning ordinarily range from $220 to $300, while retainer charges range from $2,300 to $6,000, the Kitces concentrate on found.

Bottom Line

Financial planning is tied in with taking a gander at all components of an individual’s monetary life and pondering an arrangement to help you as a specific meet your responsibilities and accomplish your objectives. It can include several services such as tax planning, estate planning, philanthropic planning, and college funding planning. You might pay based on an hourly fee, a flat fee, or an asset-based fee.

Tips for Your Financial Plan

- Financial planning is critical, however, it tends to be threatening to do it all alone. Finding a financial advisor doesn’t have to be hard. Smart Asset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Before conversing with a consultant, you can ponder how you need to possibly evenly divide your investable resources. Use this free asset allocation calculator to figure out the right balance for you based on your risk tolerance.

Conclusion

In conclusion, financial planning is a strategic process that helps individuals and businesses achieve their financial goals by managing income, expenses, investments, and risks It includes setting clear targets, making a spending plan, contributing carefully, and routinely investigating progress to keep focused.

Powerful monetary arranging guarantees long-haul monetary soundness, considering better independent direction and readiness for life’s vulnerabilities. Whether for privately invested money the executives or business development, monetary arranging is fundamental for building a safe and prosperous future. By assuming command over funds today, people and associations can make a guide for accomplishing their monetary goals.

What is the financial planning process?

There are six stages in the monetary arranging process: sorting out your financial circumstances, recognizing goals, taking apart your continuous blueprint, encouraging a money-related game plan, and noticing headway and reviving. This is a phenomenal request to present if you're contemplating working with a financial coordinator.

How to calculate finances?

Attempt the 50/30/20 rule as a straightforward planning system. Permit up to half of your pay for needs, including obligation essentials. Leave 30% of your pay for needs. Commit 20% of your pay to investment funds and obligation reimbursement past essentials.

What is the finance formula?

What are finance formulas? Finance formulas are principles, facts, or rules that you can express using maths symbols to represent financial concepts. They usually have an equal sign and two or more variables. Knowing the value of one quantity can help you apply the formula to determine the value of an unknown quantity.

How do you divide your income?

The idea is to divide your pay into three classes, burning through half on needs, 30% on needs, and 20% on hold reserves. Concentrate on the 50/30/20 spending plan decide and accept that it's great for you.